Early learning and childcare workers compensation insurance

New South Wales

Information for employers

Workers compensation can be complex, especially as an early learning and childcare employer. We provide a range of information on workers compensation for employers in New South Wales.

Helpful guidance for employers

Claims information

You can notify Guild Insurance of a workers compensation injury in a matter of minutes by completing our online notification form. The sooner you notify us of an injury, the sooner we can provide assistance to both you and your employee.

Renewing your policy

There's a few steps to renewing your workers compensation policy. Please view the steps involved in renewing your workers compensation policy.

Managing your policy

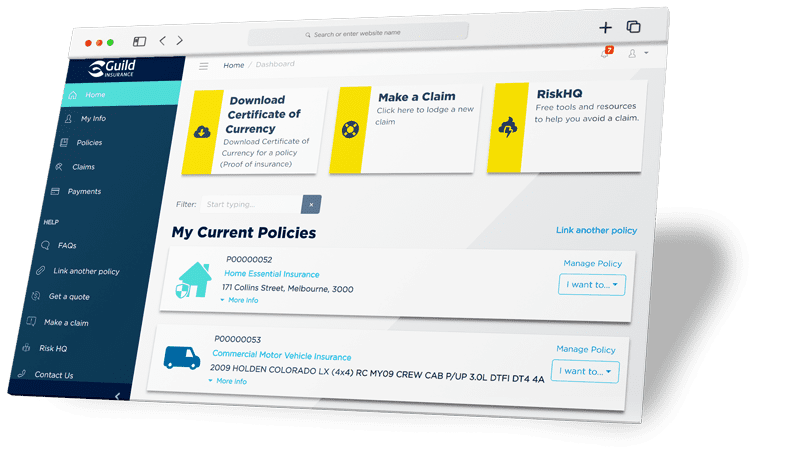

PolicyHub

Take control of your own insurance online with PolicyHub.

- Update your business details

- Access policy documents

- Access tax invoices

Find our more about what you can do in PolicyHub →

Employer wages information and links

Understanding and organising wages is important when it comes to workers compensation insurance because it ensures that you are receiving the correct coverage and have an accurate premium.

Definition of wages and contractors

Understand what to include when you are estimating or declaring actual wages in our Definition of wages guide.

Understand how to determine if contractors should be included in wage declarations, based on state laws. This document lists the characteristics distinguishing contractors from workers, such as independence, payment methods, and provision of tools.

Calculating your premium

Understanding how to calculate your workers compensation insurance premium in NSW helps ensure you're accurately budgeting for employee protection and compliance with legal requirements.

Risk management

At Guild, we’re an additional resource you can rely on to help your business.

Fill in the Employer risk management questionnaire to identify if there are any gaps in your current operation, and place the 'If you are injured at work' poster somewhere all employees will see it in case an incident occurs.

Workplace safety improvement checklists

A series of practical self-assessment checklists for the areas most commonly involved in workers compensation claims - the knee, back, wrist, ankle, and mental well-being. These checklists are designed to help businesses proactively identify risks, strengthen safety practices, and foster a more supportive and healthy work environment. Download the checklists and review your workplace against the prompts to identify opportunities to reduce injuries, support employee wellbeing, and better protect your workers.

Information for recovering workers

Getting your worker recovered and ready to get back to work can be a difficult process. These resources are designed to help manage this process.

Assisting your workers back to work

The attached guides are designed to assist you in finding light duties available at your workplace. Tick the ones that are appropriate for you, these can then be sent to the workers Treating Doctor and they can then certify which ones will be appropriate depending on the workers injury and restrictions.

More information on Early InterventionComplaints and dispute resolution

Complaints and dispute resolution is a process that helps customers resolve issues they have with our products or services. This process is designed to be fair, quick, and easy for customers to use.

FAQs for early learning employers NSW

Review our “Definition of Wages sheet” which lets you know what you need to include depending on your state/territory. If you have any queries after reviewing this, please speak to your Account Manager.

Everyone that believes that they are a worker that injures themselves in the course of employment has the right to make a claim. Your Case Manager at Guild Insurance will speak to all stakeholders and take into account the information they provide before making a liability decision.

Your workers' compensation premium is primarily based on the wage details provided in your Estimated Wages Declaration form. Additional factors that influence your premium include:

- Industry type: the nature of your business and its associated risk level.

- Cost of previous workers' compensation claims: the financial impact of past claims.

- Claims history: the frequency and severity of previous claims.

- Government charges: any applicable regulatory fees or charges.

Premium adjustment process: At the end of the policy term, your premium is adjusted based on your Actual Wages Declaration form. If your actual wages are lower than estimated, you may receive a refund. Conversely, if your actual wages are higher than estimated, you may need to pay an additional amount.

You must include Super and directors fees in NSW. In other states refer to the Definition of Wages flyer to understand more, or contact your Account Manager for clarification.

A ‘Worker’ is generally someone employed under a contract of service, whether written, oral, or implied, or who works under a contract at piecework rates, primarily for labour. If you are unsure, please check with your Account Manager or review the regulator website for your state/territory.

Employers must have current workers’ compensation insurance and prominently display insurance details at each workplace.

Reporting a claim within the required timeframe can help lower claim costs, which helps reduce any premium impact.

Yes, once liability is accepted, employers must continue paying an injured worker on regular pay days following an injury. If liability hasn’t been accepted, talk to your worker as they may want to claim sick or annual leave in the meantime. You would need to reimburse this leave if/when the claim is accepted.

A Return to Work Plan is a written plan that outlines how an employer will help an injured worker get back to work safely. It includes a list of support tasks by the employer and worker, a timeline to work toward, and any further requirements. See our return to work documents above (or in the Employer section for workers’ compensation of your state).

The doctor chosen by the worker to oversee their injury management and treatment.

A Register of Injuries is a mandatory record that documents all workplace injuries or illnesses, regardless of whether a workers' compensation claim is made. This register can be maintained either in written form or electronically (e.g., on a computer).

Purpose of a Register of Injuries:

- Accessibility: ensures all workers can report injuries or illnesses, helping to identify and address safety issues.

- Safety improvement: assists in developing new safe work procedures based on recorded incidents.

- Compliance: avoids penalties associated with failing to maintain a register.

What to Include in the Register of Injuries:

- Name of the injured worker

- Worker's address

- Worker's age at the time of injury

- Worker's occupation at the time of injury

- Industry in which the worker was engaged at the time of injury

- Time and date of injury

- Nature of the injury

- Cause of the injury

A Certificate of Currency confirms that your policy is active. It is also sometimes referred to as ‘proof of insurance’.

All employers must cover the first week of an injured worker’s weekly compensation benefits.

In NSW, you must have workers’ compensation insurance if you:

- Pay more than $7,500 in annual wages (value stated as of March 2025).

- Employ apprentices or trainees.

- Are a member of a workers’ compensation group.

A worker is someone employed under a contract of service or a training contract with an employer.

We provide a step-by-step guide to help you manage workplace injuries effectively. See our return to work and injury management plan documents above (or in the Employer section for workers’ compensation of your state).

If a claim is accepted, you must pay the injured worker at the current award wage rate.

An Injury Management Plan (IMP) is a comprehensive plan developed to support an injured worker's recovery and return to work. It is created in consultation with the worker, their employer, treating health professionals, and relevant healthcare providers. It includes goals, actions and supports, timeframes, and responsibilities.

The primary purpose of an IMP is to ensure a coordinated approach to treatment, rehabilitation, and potential retraining, facilitating a timely, safe, and durable return to work for the injured worker.

See our Injury Management Plan section above (or in the Employer section for workers’ compensation of your state).

- If you've ceased trading: You can cancel your policy if your business has ceased trading, and you can provide evidence.

- If you've sold your business: You can cancel your policy if you sell your business. The new owner will need to take out a new workers compensation insurance policy to cover employees.

- If you cease to employ workers: If you cease to employ but there's a claim in the current policy period, you can cancel your policy at the next policy expiry.

- If you become an exempt employer: You can cancel your policy under this condition.

- If you have a current policy and your wages decrease to $7,500 or less: You can cancel the policy at expiry and the premium you pay will depend on the wages you declare, however the minimum premium is $175.

- If you take out a policy and don't employ workers: If you take out a policy, pay part or full premium and subsequently don't pay wages, we can cancel the policy but the minimum premium payable is $175.

Other situations: You can contact us to discuss your reasons for wanting to cancel the policy.

- If you take out a new policy at a lower premium after 4pm on the due date: We policy under this condition.

- If a liquidator or administrator is appointed and you continue trading: Even if the liquidator or administrator attempts to take out a new policy, we cannot cancel your existing policy.

Not just an insurance policy

Risk articles with RiskHQ

You can visit RiskHQ at any time to read up about the unique risks you face as a business. We cover a variety of risk management topics, from managing complaints, to social media risks, maintaining your business and protecting your workers.