Acupuncturists & chinese medicine indemnity and liability insurance

When you’re insured with Guild, you will be covered for everything the Chinese Medicine Board of Australia (CMBA) requires – and then some!

Principal partner of

If you're forced to defend your professional reputation, you'll want the best support behind you.

Our policies include three types of insurance in one designed specifically for health professionals combining: professional indemnity insurance, public liability insurance, and product liability insurance.

Product liability

Insurance cover for liability for injury or property damage caused by goods sold or supplied by you. This can include clients getting injured or unwell from products you provide, like herbal supplements, moxibustion tools and others.

Cover and benefits of this acupuncture and chinese medicine insurance policy

Nil basic excess on liability claims

Run-off cover which protects you when you’ve ceased practising permanently

Cover for legal costs and expenses associated with complaints to your registration body, disciplinary proceedings or a coronial inquiry

Provides a 21-day cooling-off period, allowing you to change your mind after purchasing coverage

Ongoing education through our RiskHQ, providing you with relevant and informative information on the risks that matter to you

Round-the-clock support with 24 / 7 claim support line availability

To find out more or to get your hands on our policy wording, simply call us on 1800 810 213.

Common acupuncture and chinese medicine FAQs

The law governs that any professional exercise the required skill to an appropriate level expected by that profession. A professional may be liable for financial loss, injury or damage arising from an act, error or omission of fault if the professional has not acted to the required level of skill deemed in that profession. Failure through this may result in the claimant (person who suffered the loss) be awarded for that loss, damage or injury.

Many professions require you to hold a professional indemnity insurance policy by law, such as Ahpra registered professions, but can be for other industries such as financial institutions also. Please check with your registration body or associations of your profession to know if it is required by law to have professional indemnity insurance. It is often also required by companies who take on contract workers that are not governed under the companies own insurance policy. It is acceptable for a company to ask you as the professional contractor to provide evidence of cover for professional indemnity before starting the contract period.

As stated above professional indemnity insurance covers you for breaches in relation to your professional duty. Liability insurance covers you for activity that results in personal injury or property damage as a result of your business activities that do not relate to your specific profession. An example may be someone who trips and is injured from spilled water within your office may be covered under liability, because it is your duty of care as business person to provide a safe environment. Whereas a person who suffers a loss or injury because of your professional treatment in relation to your job has caused it would usually be consider as an indemnity breach.

Generally business insurance is to cover the physical assets of your business for material damage loss and options for theft cover. It can also include cover for financial loss due to business interruption. Usually basic insurance does not cover breach of duty or flood cover, but if you speak to an insurance specialist it can often be added to your policy for a nominal fee.

Depending on the policy you are taking out, covers will often vary. At Guild insurance we specialise in making a policy to suit your business so that you are not over paying for covers you wouldn't normally need. The best thing to do is call 1800 810 213 to speak to an insurance specialist, they can find out what activities and structure your business is in to then provide you with adequate cover for you.

A certificate of currency (or COC for short) is a written document that confirms that your insurance policy is current and valid at a specific date and time. At Guild we provide easy access to your COC at any time within a few clicks of our online portal PolicyHub. If you are a new customer we can provide you with one post purchase.

Our partnership with AACMA

Guild is the principal partner of AACMA.

We work closely with your association to tailor an insurance policy suited to your unique needs.

AACMA is Australia’s peak body for acupuncture and Chinese medicine professionals, dedicated to supporting the health and wellbeing of Australians.

Not just an insurance policy

Risk articles with RiskHQ

You can visit RiskHQ at any time to read up about the unique risks you face as a health professional. We cover a variety of risk management topics, from managing complaints, to social media risks, maintaining your health centre, and much more.

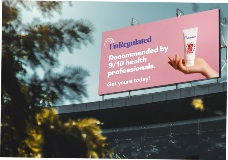

Stay on the right side of Ahpra’s advertising requirements

While there are laws for advertising any business in Australia, the Australian Health Practitioner Regulation Agency (Ahpra) has specific requirements for anyone advertising a regulated health service. These requirements apply equally to all types of health professionals regulated by Ahpra.

Importance of Informed Consent

Guild Insurance’s vast experience in managing claims made against health practitioners has highlighted that many practitioners don’t meet all their informed consent requirements.

Insurance for acupuncture and chinese medicine centres

If you run an acupuncture clinic or Chinese medicine practice and need insurance for your premises, equipment, and more, visit our information on business insurance for acupuncture and Chinese medicine professionals.

*Coverage up to $20 million requires your selection of cover up to this limit during the quote and purchase process.