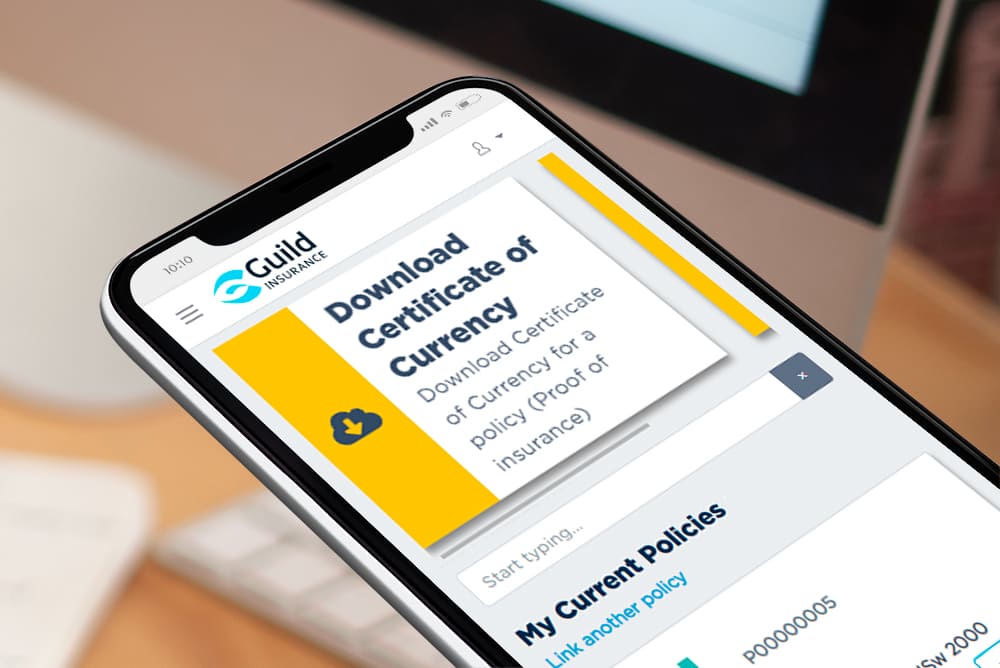

Did you know you can update your policy details and download policy documents with the click of a button in PolicyHub? see what else you can do in PolicyHub |

Insurance for fitness professionals, gyms, and fitness centres

As a fitness professional, you need to know that your insurance policy is always in fit form. Which is why we’ve made sure our policies are informed by fitness professionals to suit the unique needs of your profession.

You can keep thriving knowing you’re protected by an insurance company with your best interests as a fitness professional at heart.

Professional indemnity and liability

Protects you for what you do as a fitness professional personal trainer or instructor.

Business

insurance

Protects your gym, fitness centre or training facility for building, contents and more.

Professional indemnity insurance covers you for your civil liability when a claim arises from a breach of your professional duty. For many professional policies at Guild Insurance combine professional indemnity, public liability, and product liability to cover more of your professional duties. Business insurance, on the other hand, is a broader category that encompasses various types of coverage designed to protect businesses from a wide range of risks. This can include property damage, theft, and liability claims from third parties.

For professionals providing advice or services:

- Assess your service risk: Evaluate the potential risks associated with your professional advice or services. Consider the possibility and implications of your advice or actions leading to a client's physical, psychological, or financial detriment. Reflect on the likelihood and consequences of a situation where an error or omission on your part could lead to legal action.

- Understand legal requirements: Familiarise yourself with the legal and regulatory landscape relevant to your profession. Is holding professional indemnity insurance a legal requirement or an industry standard in your field?

For certain contract positions and many allied health professionals regulated under Ahpra require professional indemnity and/or public liability insurance. - Consider your financial exposure: If faced with a legal claim, could you afford the legal defence and potential damages out of pocket?

For business owners protecting their operations:

- Identify your business assets: Determine which physical assets are crucial to your business operations, such as property, equipment, and inventory. Consider the consequences if these assets were damaged, stolen or lost.

- Evaluate liability risks: How likely is it that someone could be injured or their property damaged because of your business activities? This includes both public liability and product liability.

- Consider business interruptions: Think about the resilience of your business in the face of unforeseen events that might force temporary closure. How would such interruptions impact your financial stability?

If you are unsure of the cover you require, please contact us on 1800 810 213 to speak to an insurance specialist.

Key Product Features

Discover the limits and coverage built in to every Guild fitness liabilities policy.

Vicarious Liability

The name/s on your policy are the names that are covered for. If it's not listed, it's not covered.

Why choose Guild Insurance as a fitness professional?

Unlike many of our competitors, we are a 100% owned direct insurer. Which means not only do we work with your association (AUSactive) with developing your policy, we work with them while administering it.

We don’t answer to an international head office, and your policy is secured right here in Australia. All decisions are made at Guild, by someone who has a relationship with your association.

We partner with:

Hear from other fitness professionals and gym owners

Feb 2024

I have been with Guild for over 4 years now and I have had such a great experience. Guild has always been flexible with my insurance cover when I have decided to stop Personal Training and then return... I have recommended them to 3 of my personal training colleagues...

May 2023

You guys insure exactly what you say you insure and pay when required - it's actually so refreshing

Feb 2024

Every time I've called Guild, the people I've spoken with have been very helpful, knowledgeable, polite and looked after me well. Thank you Guild : )

Working with over 130 associations

Insuring Australians for over 60 years

100% Australian owned

Learn how fitness professionals avoid claims with RiskHQ

Fitness professionals and their risks

Guild Insurance undertakes regular reviews of the claims reported to us to understand trends and themes within those claims. The information gained from this process suggests that some fitness professionals aren’t recognising the risks within their work, or they aren’t being proactive enough to properly manage those risks.

The following information will assist fitness professionals in understanding the risks they face in their day-to-day work and what they need to do to reduce the likelihood of these risks becoming a reality.

Don’t underestimate the importance of communication

Guild’s claims experience shows us that poor communication is a factor in almost all complaints from fitness clients. In some cases, clients will allege the communication from the fitness professional was poor and this led to an incident, such as the explanation for how to perform an exercise was too brief and this resulted in the client injuring themselves. In other cases, the client may not mention anything about communication when lodging their complaint, yet when the incident is investigated, it’s found there has been a communication breakdown between the fitness professional and the client. Fitness professionals need to focus not only on their technical knowledge but also their communication skills when communicating any information to clients.

Don’t underestimate the risk of poor exercise selection and prescription

Exercise has the potential to provide a great deal of enjoyment while also providing health and fitness benefits. However, Guild’s experience in managing fitness claims provides evidence that there are also significant risks attached to exercise; clients can suffer life changing injuries. Yet this doesn’t mean we should stop exercising, it means we need to pay closer attention to the risks of exercise and put in place risk mitigation strategies to reduce the likelihood of these injuries occurring. Hoping a client won’t be injured isn’t enough. The risk of exercise needs to be understood and mitigated.

Work within your scope of practice

Fitness professionals need to be sure they understand, and work within, their scope of practice. This means knowing what they’ve been trained to do and are competent in. Giving advice outside this scope will potentially be creating a risk for the client, which in turn becomes a risk for the professional. Fitness professionals need to be sure that regardless of what information or program the client has requested, they only plan and deliver exercise programs within their scope. If the client’s needs or requests are outside of this, the professional needs to seek assistance or refer the client to someone else. Fitness professionals need to remember they’re responsible for all professional advice and guidance they provide, so they should never allow themselves to be coerced into doing something they know they shouldn’t.

Keep records of sessions

It’s important to keep a record of your sessions with clients. This means maintaining an accurate and detailed history of what exercises your client has performed and the specifics of those exercises in terms of weight, height, sets, repetitions etc. It also means you have details of how successfully the client performed those exercises and if there were any issues such as injuries. Records of your sessions with clients serve two key purposes:

- Continuity of service – this means you don’t have to rely on your memory to recall what took place in previous sessions, you have a documented history which will help guide you and your client in future sessions.

- Defence of an allegation – if there’s an allegation against you of wrongdoing, your records will assist in your defence as they provide evidence of what actually took place.

Balance encouragement and pushing too far

It’s quite common to hear clients allege their trainer pushed them too hard when they had told the trainer the exercise was beyond their capability, which led to them suffering an injury. But where is the line between encouraging a client to challenge and improve their fitness and pushing too far that it becomes a risk? Unfortunately, this line isn’t always obvious. Therefore, fitness professionals need to be sure they’re tailoring all they do to each individual client and watch for signs that the client is struggling to a point of potential harm.

Balance creativity and risky

Like all good business people, fitness professionals are continually looking for new and different offerings for their clients and ways to set themselves apart from their competitors. However, this ingenuity can create new risks for the business. The risks of any new offerings need to be carefully considered before being put into place – think about what can go wrong before it does. Guild has seen many claims where clients have been seriously injured undertaking an activity where it could be argued that the risks of the activity outweigh the likely benefits.

Be proactive with managing risks

Guild has seen numerous cases where the fitness professional has identified a potential risk or hazard, such as a pothole where clients are jogging, or weights being left on the floor rather than on racks, yet they’ve put in very little, if any, effort to manage that risk. Warning clients to avoid a pothole while running is not proactively managing a risk. Moving the clients away from the pothole is going to be much more effective in preventing an injury. When a risk assessment is done, and this leads to risks being identified, fitness professionals need to be sure they’re taking the necessary steps to reduce the likelihood of that risk eventuating. Hoping it won’t happen isn’t enough.

And finally…

Don’t think it won’t happen to you. No fitness professional is immune from the risks involved in training clients. The more aware a professional is of what could possibly go wrong, the more equipped they are to prevent it.

- Exercise Professionals

- Fitness

- Professional

More frequently asked questions for fitness professionals

The law governs that any professional exercise the required skill to an appropriate level expected by that profession. A professional may be liable for financial loss, injury or damage arising from an act, error or omission of fault if the professional has not acted to the required level of skill deemed in that profession. Failure through this may result in the claimant (person who suffered the loss) be awarded for that loss, damage or injury.

Many professions require you to hold a professional indemnity insurance policy by law, such as Ahpra registered professions, but can be for other industries such as financial institutions also. Please check with your registration body or associations of your profession to know if it is required by law to have professional indemnity insurance. It is often also required by companies who take on contract workers that are not governed under the companies own insurance policy. It is acceptable for a company to ask you as the professional contractor to provide evidence of cover for professional indemnity before starting the contract period.

As stated above professional indemnity insurance covers you for breaches in relation to your professional duty. Liability insurance covers you for activity that results in personal injury or property damage as a result of your business activities that do not relate to your specific profession. An example may be someone who trips and is injured from spilled water within your office may be covered under liability, because it is your duty of care as business person to provide a safe environment. Whereas a person who suffers a loss or injury because of your professional treatment in relation to your job has caused it would usually be consider as an indemnity breach.

Generally business insurance is to cover the physical assets of your business for material damage loss and options for theft cover. It can also include cover for financial loss due to business interruption. Usually basic insurance does not cover breach of duty or flood cover, but if you speak to an insurance specialist it can often be added to your policy for a nominal fee.

Depending on the policy you are taking out, covers will often vary. At Guild insurance we specialise in making a policy to suit your business so that you are not over paying for covers you wouldn't normally need. The best thing to do is call 1800 810 213 to speak to an insurance specialist, they can find out what activities and structure your business is in to then provide you with adequate cover for you.

A certificate of currency (or COC for short) is a written document that confirms that your insurance policy is current and valid at a specific date and time. At Guild we provide easy access to your COC at any time within a few clicks of our online portal PolicyHub. If you are a new customer we can provide you with one post purchase.

Login to PolicyHub for all your policy needs

- All-In-One Dashboard: Manage all your policies and documents in one place.

- Easy Updates: Quickly update personal and business details online.

- Enhanced Security: Protect your account with multi-factor authentication.

- Document Access: Instantly access policy documents and tax invoices.

- Claim Management: View current and past claims effortlessly.

- Flexible Payments: Update billing details.

- Policy Renewal & Reinstatement: Renew or reinstate policies with ease directly through PolicyHub.

- Certificates of Currency: Obtain proof of insurance with just a few clicks.

Write a review Average rating: