Insurance for dentists

When it comes to insurance, we don't want you to simply go with the flow. Which is why at Guild, we're constantly evolving to reflect the real-life needs of dentists like you.

Join Guild Insurance today and choose to be protected by an insurer that's worked hand in hand with ADA NSW, ADA SA, ADAVB and ADATAS for over 25 years.

Professional indemnity and liability

Protects you for what you do as a dentist.

Business

insurance

Protects your dental practice and items in it.

Professional indemnity insurance covers you for your civil liability when a claim arises from a breach of your professional duty. For many professional policies at Guild Insurance combine professional indemnity, public liability, and product liability to cover more of your professional duties. Business insurance, on the other hand, is a broader category that encompasses various types of coverage designed to protect businesses from a wide range of risks. This can include property damage, theft, and liability claims from third parties.

For professionals providing advice or services:

- Assess your service risk: Evaluate the potential risks associated with your professional advice or services. Consider the possibility and implications of your advice or actions leading to a client's physical, psychological, or financial detriment. Reflect on the likelihood and consequences of a situation where an error or omission on your part could lead to legal action.

- Understand legal requirements: Familiarise yourself with the legal and regulatory landscape relevant to your profession. Is holding professional indemnity insurance a legal requirement or an industry standard in your field?

For certain contract positions and many allied health professionals regulated under Ahpra require professional indemnity and/or public liability insurance. - Consider your financial exposure: If faced with a legal claim, could you afford the legal defence and potential damages out of pocket?

For business owners protecting their operations:

- Identify your business assets: Determine which physical assets are crucial to your business operations, such as property, equipment, and inventory. Consider the consequences if these assets were damaged, stolen or lost.

- Evaluate liability risks: How likely is it that someone could be injured or their property damaged because of your business activities? This includes both public liability and product liability.

- Consider business interruptions: Think about the resilience of your business in the face of unforeseen events that might force temporary closure. How would such interruptions impact your financial stability?

If you are unsure of the cover you require, please contact us on 1800 810 213 to speak to an insurance specialist.

Key Product Features

Discover the limits and coverage built in to every Guild dentist liabilities policy.

Renewal FAQs

See the latest frequently asked questions and information for renewals in 2025.

Association Endorsed

Find out more about our long standing partnership with several branches of the ADA.

Hear from other dentists

01/09/2024

01/07/2024

01/01/2025

Working with over 130 associations

Insuring Australians for over 60 years

100% Australian owned

Learn how Dentists avoid claims with RiskHQ

Stay on the right side of Ahpra’s advertising requirements

While there are laws for advertising any business in Australia, The Australian Health Practitioner Regulation Agency (Ahpra) has specific requirements for anyone advertising a regulated health service. And these requirements apply equally to all types of health professionals regulated by Ahpra.

These advertising requirements are set under Section 133 of the Health Practitioner Regulation National Law. Therefore, breaching an advertising requirement is a criminal offence for which prosecution and financial penalties can apply. For an individual, there may be a penalty of up to $60,000 per offence and $120,000 for a body corporate.

Where to get the facts

It’s incredibly important that all health practitioners and health practices who advertise a regulated health service make themselves fully aware of these requirements and what they need to do to comply.

The information in this article summarises the key requirements, yet it’s important to refer to the information provided by Ahpra to be fully informed, which can be found at ahpra.gov.au/Resources/Advertising-hub.

Within the hub, you’ll find the document titled Guidelines for advertising a regulated health service, published December 2020, which provides a wealth of information and guidance.

What’s advertising?

Ahpra defines advertising as ‘all forms of verbal, printed or electronic public communication that promotes a regulated health service provider to attract a person to the provider (practitioner or business).’

This includes all forms of advertising such as websites, social media, flyers, billboards, signage and business cards.

What’s not allowed?

There are five advertising requirements regarding what’s not allowed in advertising according to the National Law (listed below as (a) through to (e)).

Section 133 of the National Law states that a person must not advertise a regulated health service, or a business that provides a regulated health service, in a way that:

- (a) is false, misleading or deceptive or is likely to be misleading or deceptive

This requires advertising to be honest and factual, with consideration for the audience and their level of understanding. The information should be detailed as partial information has the potential to be misleading. The information also needs to be based on “acceptable evidence”; an explanation of this can be found in the Guidelines document.

- (b) offers a gift, discount or other inducement to attract a person to use the service or the business, unless the advertisement also states the terms and conditions of the offer

The terms and conditions need to be clear, not misleading and in language that can be understood by the intended audience. Details of price, and the services to be provided, must be easily understood.

- (c) uses testimonials or purported testimonials about the service or business

A testimonial, in this instance, refers to a positive statement about the clinical aspects of a regulated health service. Testimonials aren’t allowed as they’re often biased, subjective and misleading and won’t apply to all patients and their unique clinical situations.

- (d) creates an unreasonable expectation of beneficial treatment

Patients need to have realistic expectations regarding treatment outcomes. This means not making unsubstantiated scientific claims or overstating the potential benefit of treatment. It’s also important to not minimise the risk of harm by declaring treatment to be safe or risk-free, as all healthcare treatment carries some level of risk.

- (e) directly or indirectly encourages the indiscriminate or unnecessary use of regulated health services

Advertising shouldn’t encourage the public to buy or use a regulated health service they don’t need or is of no benefit. It’s important to not create a sense of urgency or encourage regular appointments when not clinically indicated.

Use of titles

Accuracy and detail in titles when advertising is important to be sure the public understand the qualifications and registration type of a health professional. And this information doesn’t have to be false to be misleading.

All registered health professions regulated by Ahpra are protected titles under the National Law. Therefore, those titles can only be used in advertising by professionals qualified and registered under that profession.

The use of protected titles extends to specialist registration. It’s considered that if a practitioner doesn’t hold specialist registration, using words such as ‘specialist’, ‘specialises in’, ‘specialty’ or ‘specialised’ may be misleading or deceptive and therefore in breach of the guidelines.

“Doctor” (or “Dr”) isn’t a protected title and can be used by various types of health professionals. However, as the public have historically used this term to refer to medical practitioners, it could be misleading in advertising. Therefore, if the use of “Dr” doesn’t refer to a medical practitioner, it must be made clear the type of health professional it’s referring to.

What you’re responsible for

Health practitioners are responsible for compliance with advertising requirements when they have control over that advertising. This means that, for example, if a testimonial is posted on a practitioner’s social media page, they’re able to remove it and must do so; to leave it would be in breach.

However, if that testimonial is posted on a public review site, the practitioner isn’t expected to remove it or try to have it removed. Yet they are expected not to promote, through ‘likes’ or ‘shares’, those testimonials they can’t remove.

Anyone who advertises a regulated health service is considered an advertiser and is responsible for ensuring their advertising complies. Therefore, advertising created by others, such as a marketing or advertising professional, needs to be checked by the responsible advertiser to be sure it isn’t in breach.

Guild Insurance encourages health practitioners regulated by Ahpra to review all of their advertising and make any necessary changes immediately to be sure they’re not in breach. Remember, these advertising requirements are the law!

- Acupuncture

- Chiropractors

- Dental Prosthetists

- Dentists

- Medical

- Nurses

- Optometrists

- Osteopaths

- Paramedics

- Pharmacists

- Pharmacy

- Physiotherapists

- Physiotherapy Business Insurance

- Podiatrists

- Psychologists

- Business

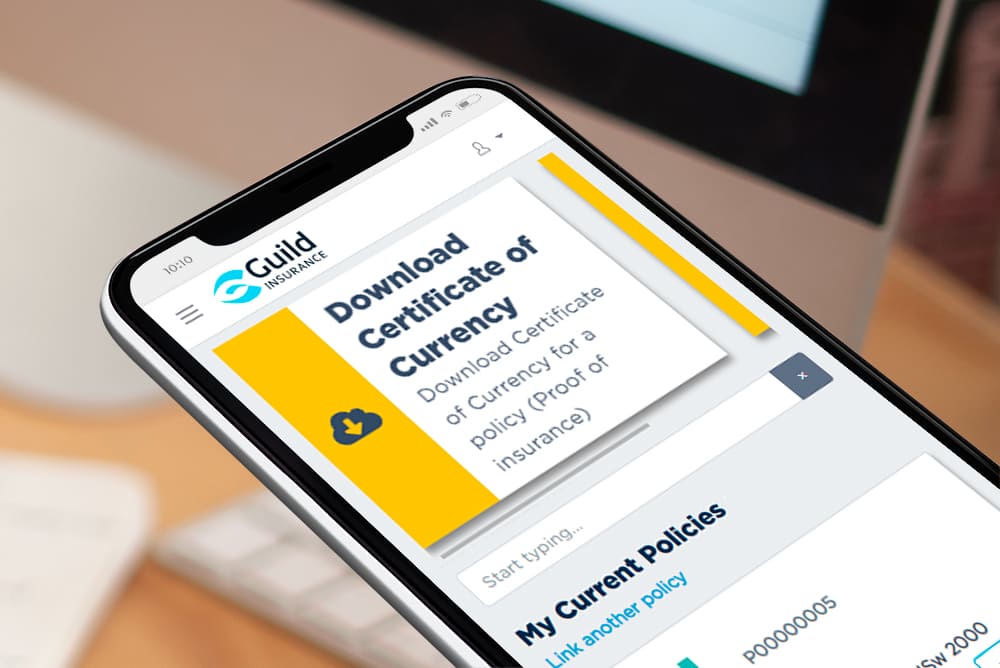

Login to PolicyHub for all your policy needs

- All-In-One Dashboard: Manage all your policies and documents in one place.

- Easy Updates: Quickly update personal and business details online.

- Enhanced Security: Protect your account with multi-factor authentication.

- Document Access: Instantly access policy documents and tax invoices.

- Claim Management: View current and past claims effortlessly.

- Flexible Payments: Update billing details.

- Policy Renewal & Reinstatement: Renew or reinstate policies with ease directly through PolicyHub.

- Certificates of Currency: Obtain proof of insurance with just a few clicks.

FAQs

The law governs that any professional exercise the required skill to an appropriate level expected by that profession. A professional may be liable for financial loss, injury or damage arising from an act, error or omission of fault if the professional has not acted to the required level of skill deemed in that profession. Failure through this may result in the claimant (person who suffered the loss) be awarded for that loss, damage or injury.

Many professions require you to hold a professional indemnity insurance policy by law, such as Ahpra registered professions, but can be for other industries such as financial institutions also. Please check with your registration body or associations of your profession to know if it is required by law to have professional indemnity insurance. It is often also required by companies who take on contract workers that are not governed under the companies own insurance policy. It is acceptable for a company to ask you as the professional contractor to provide evidence of cover for professional indemnity before starting the contract period.

As stated above professional indemnity insurance covers you for breaches in relation to your professional duty. Liability insurance covers you for activity that results in personal injury or property damage as a result of your business activities that do not relate to your specific profession. An example may be someone who trips and is injured from spilled water within your office may be covered under liability, because it is your duty of care as business person to provide a safe environment. Whereas a person who suffers a loss or injury because of your professional treatment in relation to your job has caused it would usually be consider as an indemnity breach.

Generally business insurance is to cover the physical assets of your business for material damage loss and options for theft cover. It can also include cover for financial loss due to business interruption. Usually basic insurance does not cover breach of duty or flood cover, but if you speak to an insurance specialist it can often be added to your policy for a nominal fee.

Depending on the policy you are taking out, covers will often vary. At Guild insurance we specialise in making a policy to suit your business so that you are not over paying for covers you wouldn't normally need. The best thing to do is call 1800 810 213 to speak to an insurance specialist, they can find out what activities and structure your business is in to then provide you with adequate cover for you.

A certificate of currency (or COC for short) is a written document that confirms that your insurance policy is current and valid at a specific date and time. At Guild we provide easy access to your COC at any time within a few clicks of our online portal PolicyHub. If you are a new customer we can provide you with one post purchase.

Write a review Average rating: