Insurance for dentists

When it comes to insurance, we don't want you to simply go with the flow. Which is why at Guild, we're constantly evolving to reflect the real-life needs of dentists like you.

Join Guild Insurance today and choose to be protected by an insurer that's worked hand in hand with ADA NSW, ADA SA, ADAVB and ADATAS for over 25 years.

Professional indemnity and liability

Protects you for what you do as a dentist.

Business

insurance

Protects your dental practice and items in it.

Professional indemnity insurance covers you for your civil liability when a claim arises from a breach of your professional duty. Many professional policies at Guild Insurance combine professional indemnity, public liability, and product liability to cover more of your professional duties. Business insurance, on the other hand, is a broader category that encompasses various types of coverage designed to protect businesses from a wide range of risks. This can include property damage, theft, and liability claims from third parties.

For professionals providing advice or services:

- Assess your service risk: Evaluate the potential risks associated with your professional advice or services. Consider the possibility and implications of your advice or actions leading to a client's physical, psychological, or financial detriment. Reflect on the likelihood and consequences of a situation where an error or omission on your part could lead to legal action.

- Understand legal requirements: Familiarise yourself with the legal and regulatory landscape relevant to your profession. Is holding professional indemnity insurance a legal requirement or an industry standard in your field? For certain contract positions and many allied health professionals regulated under Ahpra, professional indemnity and/or public liability insurance is required.

- Consider your financial exposure: If faced with a legal claim, could you afford the legal defence and potential damages out of pocket?

For business owners protecting their operations:

- Identify your business assets: Determine which physical assets are crucial to your business operations, such as property, equipment, and inventory. Consider the consequences if these assets were damaged, stolen or lost.

- Evaluate liability risks: How likely is it that someone could be injured or their property damaged because of your business activities? This includes both public liability and product liability.

- Consider business interruptions: Think about the resilience of your business in the face of unforeseen events that might force temporary closure. How would such interruptions impact your financial stability?

If you are unsure of the cover you require, please contact us on 1800 810 213 to speak to an insurance specialist.

Key Product Features

Discover the limits and coverage built in to every Guild dentist liabilities policy.

Renewal FAQs

See the latest frequently asked questions and information for renewals in 2025.

Association Endorsed

Find out more about our long standing partnership with several branches of the ADA.

Hear from other dentists

01/09/2024

01/07/2024

01/01/2025

Working with over 130 associations

Insuring Australians for over 60 years

100% Australian owned

Learn how Dentists avoid claims with RiskHQ

Mitigating Cyclone Risks

Cyclones may seem like a rare event to some people in Australia. However, according to the CSIRO, northern Australia is threatened by cyclones every year between November and April with typically about five cyclones reaching land each year. This means that unfortunately cyclones are a very real part of life for many people and businesses and the devastation they cause can be catastrophic. Sadly, the recovery from cyclone damage is often not as quick as people would hope and this can have significant consequences for businesses.

We can’t prevent a cyclone from occurring, but we can take steps to reduce its impact. The following tips will assist business owners and their staff be better prepared for a cyclone and better able to reduce impacts to the business. They’ll help you get back on your feet and trading again sooner.

Pre-cyclone planning

- Make yourself aware of the cyclone risk and likelihood for the location you’re in. If new to an area, engage with others who live and work there to understand the cyclone history of that area.

- Have an evacuation plan and ensure all staff are familiar with this. It should include details on the likely warning timeframes and any possible shelter options. Again, engage with others in the area to assist in creating a safe plan.

- Prepare an emergency kit that allows access to important information, equipment or tools. There’ll be occasions where the damage to a building is so great that it can’t be safely entered. Therefore, business owners must consider what they’ll need to access to both deal with the damage caused (such as insurance details and an asset register) and maintain business operations as much as is possible.

- Have a plan to minimise the spoilage of any refrigerated items in the event of power being lost.

- Have your data and any business information which is stored electronically backed up in a way that can be accessed off site. This is important if the premises can’t be accessed or if information has been lost due to power shortages. Alternatively, consider cloud hosted storage solutions to protect your data.

- Ensure your business’ asset register is up to date. A detailed asset register means the process of an insurance claim is much faster and hassle free.

- Discuss insurance cover, including business interruption, and its costs with your Guild Insurance Account Manager or insurance adviser and ensure you understand the financial protection afforded to you in the event of a cyclone.

- Find out if your building has been built to cyclone standards and make modifications where possible.

- Have a maintenance program in place so your building is in an ideal condition. A building which has been allowed to deteriorate or has been poorly maintained is likely to suffer more serious damage.

- If there are maintenance issues with your building and you lease the premises, engage with your landlord as soon as possible to discuss a plan and the necessary action.

- Develop a business continuity plan that will detail how you’ll manage your customer needs as well as your business and financial needs immediately after a catastrophic event. Thinking about this before an event can make the immediate impact and stress more manageable.

- Given there’ll likely be high demand for many services and trades, it would be wise to create a list of local services before there’s an urgent need. Utilise the knowledge of your local real estate agents; they can be a great support for

putting you in touch with local trades and services.

Planning when a cyclone is imminent

- Don’t be complacent when there are cyclone warnings. Cyclones not only cause significant damage to buildings and other material possessions, but sadly they can lead to loss of life. Listen to all local advice and don’t delay evacuating.

- Have a plan for where and how you’ll access local and current advice when a cyclone is approaching, to be sure you can make the most appropriate decisions regarding when to evacuate.

- When there are warnings that a cyclone appears likely, bring inside any outdoor furniture, equipment or other items that could be blown away. Anything which can’t be brought inside should be tied down if possible.

- When evacuating a building, where possible turn off the gas and electricity supply. Be sure you know how to do this ahead of time.

Post cyclone response

- Contact your Guild Insurance Account Manager or insurance adviser as soon as is possible to notify them of the event and any losses suffered.

- If you begin the clean-up yourself and wish to dispose of any damaged and unsalvageable items, ensure you take a photo of these items first, and keep a list of what’s been thrown out, to assist with your insurance claim.

- If you aren’t fully insured and are therefore managing aspects of the clean up and recovery yourself, it’s advisable to begin by prioritising what needs to be done and determining how you’ll do this and whose assistance you’ll need. There are restoration services available that can assist with this.

- Following natural disasters, there’s often government support available to assist in the recovery. Be sure to stay up to date on what’s available from your local, state and federal governments.

- Acupuncture

- Aged Care

- Associations

- Childcare

- Chiropractors

- Dental Prosthetists

- Dentists

- Dietitians

- Early Learning

- Exercise & Sports Scientists

- Exercise Physiologists

- Exercise Professionals

- Exercise Scientists

- Fitness

- IT

- Medical

- Natural Therapists

- Neighbourhood Houses

- Not for profit

- Nurses

- Occupational Therapists

- Optometrists

- Osteopaths

- Paramedics

- Pharmacists

- Physiotherapists

- Podiatrists

- Psychologists

- Radiographers

- Rehab Provider

- Retail

- Sonographers

- Speech Pathologists

- Sport Scientist

- Tax Audit

- Training Consultants

- Veterinarians

- Vets Choice

- Workers Compensation

- Business

- Accidents

- Business Interruption

- Damage

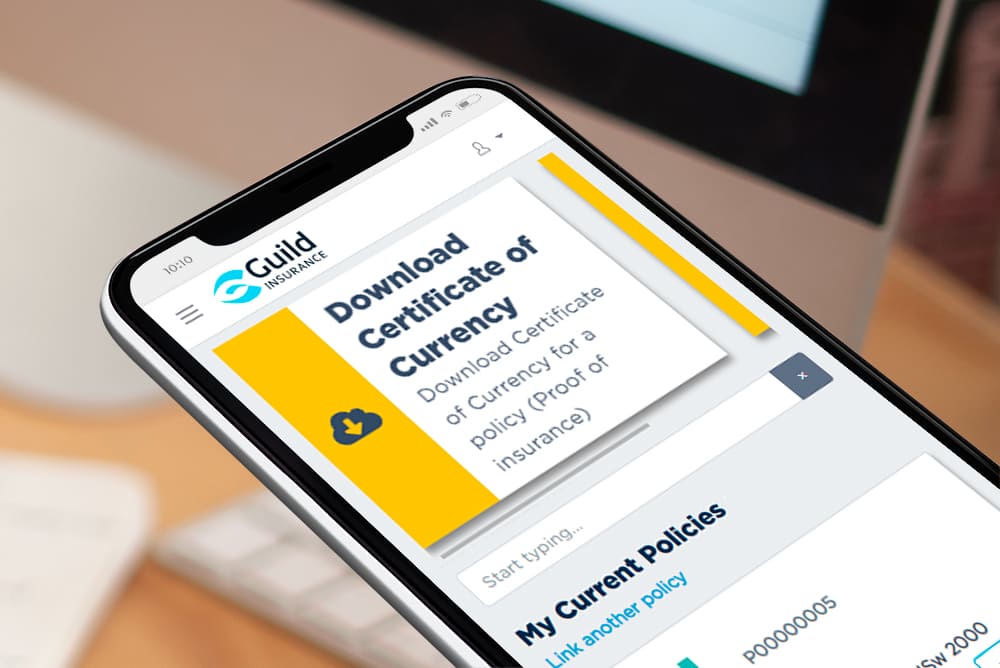

Login to PolicyHub for all your policy needs

- All-In-One Dashboard: Manage all your policies and documents in one place.

- Easy Updates: Quickly update personal and business details online.

- Enhanced Security: Protect your account with multi-factor authentication.

- Document Access: Instantly access policy documents and tax invoices.

- Claim Management: View current and past claims effortlessly.

- Flexible Payments: Update billing details.

- Policy Renewal & Reinstatement: Renew or reinstate policies with ease directly through PolicyHub.

- Certificates of Currency: Obtain proof of insurance with just a few clicks.

FAQs

The law governs that any professional exercise the required skill to an appropriate level expected by that profession. A professional may be liable for financial loss, injury or damage arising from an act, error or omission of fault if the professional has not acted to the required level of skill deemed in that profession. Failure through this may result in the claimant (person who suffered the loss) be awarded for that loss, damage or injury.

Many professions require you to hold a professional indemnity insurance policy by law, such as Ahpra registered professions, but can be for other industries such as financial institutions also. Please check with your registration body or associations of your profession to know if it is required by law to have professional indemnity insurance. It is often also required by companies who take on contract workers that are not governed under the companies own insurance policy. It is acceptable for a company to ask you as the professional contractor to provide evidence of cover for professional indemnity before starting the contract period.

As stated above professional indemnity insurance covers you for breaches in relation to your professional duty. Liability insurance covers you for activity that results in personal injury or property damage as a result of your business activities that do not relate to your specific profession. An example may be someone who trips and is injured from spilled water within your office may be covered under liability, because it is your duty of care as business person to provide a safe environment. Whereas a person who suffers a loss or injury because of your professional treatment in relation to your job has caused it would usually be consider as an indemnity breach.

Generally business insurance is to cover the physical assets of your business for material damage loss and options for theft cover. It can also include cover for financial loss due to business interruption. Usually basic insurance does not cover breach of duty or flood cover, but if you speak to an insurance specialist it can often be added to your policy for a nominal fee.

Depending on the policy you are taking out, covers will often vary. At Guild insurance we specialise in making a policy to suit your business so that you are not over paying for covers you wouldn't normally need. The best thing to do is call 1800 810 213 to speak to an insurance specialist, they can find out what activities and structure your business is in to then provide you with adequate cover for you.

A certificate of currency (or COC for short) is a written document that confirms that your insurance policy is current and valid at a specific date and time. At Guild we provide easy access to your COC at any time within a few clicks of our online portal PolicyHub. If you are a new customer we can provide you with one post purchase.

Write a review Average rating: