Insurance for dentists

When it comes to insurance, we don't want you to simply go with the flow. Which is why at Guild, we're constantly evolving to reflect the real-life needs of dentists like you.

Join Guild Insurance today and choose to be protected by an insurer that's worked hand in hand with ADA NSW, ADA SA, ADAVB and ADATAS for over 25 years.

Professional indemnity and liability

Protects you for what you do as a dentist.

Business

insurance

Protects your dental practice and items in it.

Professional indemnity insurance covers you for your civil liability when a claim arises from a breach of your professional duty. For many professional policies at Guild Insurance combine professional indemnity, public liability, and product liability to cover more of your professional duties. Business insurance, on the other hand, is a broader category that encompasses various types of coverage designed to protect businesses from a wide range of risks. This can include property damage, theft, and liability claims from third parties.

For professionals providing advice or services:

- Assess your service risk: Evaluate the potential risks associated with your professional advice or services. Consider the possibility and implications of your advice or actions leading to a client's physical, psychological, or financial detriment. Reflect on the likelihood and consequences of a situation where an error or omission on your part could lead to legal action.

- Understand legal requirements: Familiarise yourself with the legal and regulatory landscape relevant to your profession. Is holding professional indemnity insurance a legal requirement or an industry standard in your field?

For certain contract positions and many allied health professionals regulated under Ahpra require professional indemnity and/or public liability insurance. - Consider your financial exposure: If faced with a legal claim, could you afford the legal defence and potential damages out of pocket?

For business owners protecting their operations:

- Identify your business assets: Determine which physical assets are crucial to your business operations, such as property, equipment, and inventory. Consider the consequences if these assets were damaged, stolen or lost.

- Evaluate liability risks: How likely is it that someone could be injured or their property damaged because of your business activities? This includes both public liability and product liability.

- Consider business interruptions: Think about the resilience of your business in the face of unforeseen events that might force temporary closure. How would such interruptions impact your financial stability?

If you are unsure of the cover you require, please contact us on 1800 810 213 to speak to an insurance specialist.

Key Product Features

Discover the limits and coverage built in to every Guild dentist liabilities policy.

Renewal FAQs

See the latest frequently asked questions and information for renewals in 2025.

Association Endorsed

Find out more about our long standing partnership with several branches of the ADA.

Hear from other dentists

01/09/2024

01/07/2024

01/01/2025

Working with over 130 associations

Insuring Australians for over 60 years

100% Australian owned

Learn how Dentists avoid claims with RiskHQ

Case study – nobody’s perfect

On 23 December 2008 an ADA Branch received an email from a member of the public complaining about the standard of service offered to him by its after-hours emergency service when he was experiencing considerable pain from a tooth that had been filled some 3 months earlier. The key elements of the complaint were:

- The person who received the call introduced herself as the emergency dentist. She advised that she could pull the tooth for $350 or perform root canal therapy for $2,000. He would need to attend within the next hour as she would be leaving.

- The complainant declined and subsequently his regular dentist solved the problem for $220.

- He felt that the emergency dentist was attempting to take advantage of a person in considerable pain by pressuring them to make a hasty decision.

Although the ADA Branch obtained a verbal comment from the dentist’s dental assistant, it decided to wait for her to return from leave to get written details before responding. However, in the meantime it received two cool telephone calls from the complainant, and, even though full information about the incident was not known, in an attempt to defuse the situation the ADA Branch sent a response to the complainant

The key elements of the response:

- Thanked him for his email about the emergency dental service and noted that the ADA was sorry that he felt it necessary to complain.

- Advised that the service is an unsubsidized voluntary private service and consequently required patients to be scheduled at a given time, generally in the morning. The service had attended to 36 grateful patients over the Christmas period.

- The dental nurse to whom he had spoken recalled that she had advised that removal of the tooth would cost $370, including the call-out fee, and that if it was possible to save the tooth then root-canal treatment would cost $800 – $1,400 over 3 visits.

- The complainant had rudely told her that “you’ve got a good scam going” and hung up on her.

- Advised that under no circumstances would he be pressured into making a hasty decision, but on seeing the dentist he would be presented with the best options for his overall dental care

- An invitation to contact the ADA if he had any further concerns or queries.

The complainant responded to the ADA Branch on 25 January as follows:

“Madam

I am not in the habit of hanging up on any body I certainly did not in this case.

I most certainly did not say “you have a good scam going”, as I assumed that this was the necessary action.

The Lady who answered the phone told me that she was the Emergency Dentist and failed to give a name when asked.

She quoted $350.00 to pull the tooth and $2000.00 for root canal treatment.

She told me that she was at the surgery now and if I wanted Treatment to be there in an hour.

She should have offered emergency root canal therapy that was performed on me by my regular dentist.

I find it very distressing to be accused of being rude and of lying.

I am also surprised that a professional person finds it necessary to make these charges.

I await your response before taking further action on this matter.”

The ADA Branch decided that this issue was not likely to be readily resolved and thus sought legal advice from Guild Lawyers. The following email was sent to the complainant on 19 February:

“Thank you for your email transmission dated 25 January 2009. I apologise for the delay in responding.

Please rest assured that we have taken most seriously your concerns in relation to your experience of the ADA Emergency Dental Treatment program. In reporting to you the result of our enquiries with the staff member who assisted you over the telephone, no discourtesy was intended and we apologise for any distress that was caused to you in relaying the Service staff member’s version of the telephone conversation with you.

Again, thank you for your query and for drawing your concerns to our attention. It always assists us in improving the quality of the service provided to members of the public.”

There has not been a subsequent response from the complainant. The ADA Branch sought a written report from the dental assistant which was received on 31 March.

“For every phone call I receive on the emergency phone I answer in the same way which is “Emergency Dental Service XXXX speaking”. I always quote the patient to the best of my ability without knowing the exact treatment to take place, and tell them that payment needs to be made at the time of the appointment and if they have a health fund to bring their card with them.

For a simple extraction I would have quoted at the time $370 which includes a consultation, x-ray and tooth extraction. If RCT† is needed for a molar, $350 for initial appointment with at least two further appointments in future with their own dentist or specialist. If seeing a specialist for a molar the price is capped at $1400 and an anterior at $850. A crown maybe needed at a later date.

I do remember in this conversation the man saying “you have a good scam going”. I do not remember him asking my name, however I always answer the phone using my name. I do also remember saying that the fees were set and I did not have any control over them. I do also remember after he started getting quite rude asking him to direct any complaints to the ADA.

As you can imagine XXXX this phone conversation happened quite a while ago now and I do only remember some specifics to the conversation, but as I repeat myself every weekend, and have done so for the last 18 months I feel that I am consistent and do not vary the information I give to patients.”

†: Root Canal Therapy

The emergency dentist involved confirmed that the dental assistant always answers the phone as she had written in her email and had never heard anything but praise for her demeanour. The dentist had certainly never heard her be rude to anybody and was prepared to swear to this effect on a bible or in a court of law.

It should also be mentioned that before the patient rang the emergency mobile phone number, he received the following recorded message from the ADA Branch emergency line.

“Hello, this is the ADA Emergency Service. The Service operates 9 am to 6 pm on weekends and public holidays. An after-hours surcharge applies and payment is required at the time of treatment. To contact the dentist on roster please ring XXXX.”

What can we learn from this case?

First, a written response should not be sent to a complainant without a solicitor from Guild Lawyers first reviewing it. It is clearly easy for a complaint to get out of hand. The error arose in commenting in the response that:

- He had rudely told her that “you’ve got a good scam going” and hung up on her.

- Under no circumstances would he be pressured into making a hasty decision, but on seeing the dentist he would be presented with the best options for his overall dental care.”

The issue was not if the statement was factual or not, rather that the statement might be seen by the complainant as inflammatory. The complainant’s second email was more aggressive than the first:

“I am not in the habit of hanging up on any body I certainly did not in this case. I most certainly did not say “you have a good scam going”

Second, in an ideal world a written record should be kept of all incoming calls. It is not unexpected for a busy dental assistant to forget the details of a call. As the dental assistant wrote:

“…. this phone conversation happened a while ago now and I do only remember some specifics to the conversation ….”

The courts are more likely to believe the patient’s recollection of the course of events rather than the dentist’s or the dental assistant’s because the event will be a major one for the patient, whilst it is only one of many such events to the dental people. The fact that a certain response is standard practice will not convince a court of law that the advice was actually given. However, keeping a record of every person who rings into your surgery, even though they decide not to go ahead with treatment or visit the surgery, would be ‘over the top.’

The ADA Branch is grateful that the dentist in question is willing to provide the after-afters emergency service, particularly over the Christmas break. Let’s hope the dentist doesn’t have to swear to his dental assistant’s demeanour “on the bible or in a court of law.”

The final message from this case is that no matter how courteous you are complaints can happen. Do not forget the adage of “there but for the grace of God go I.”

By Claudya Adamczewski and Len Crocombe

- Dentists

- Business

- Professional

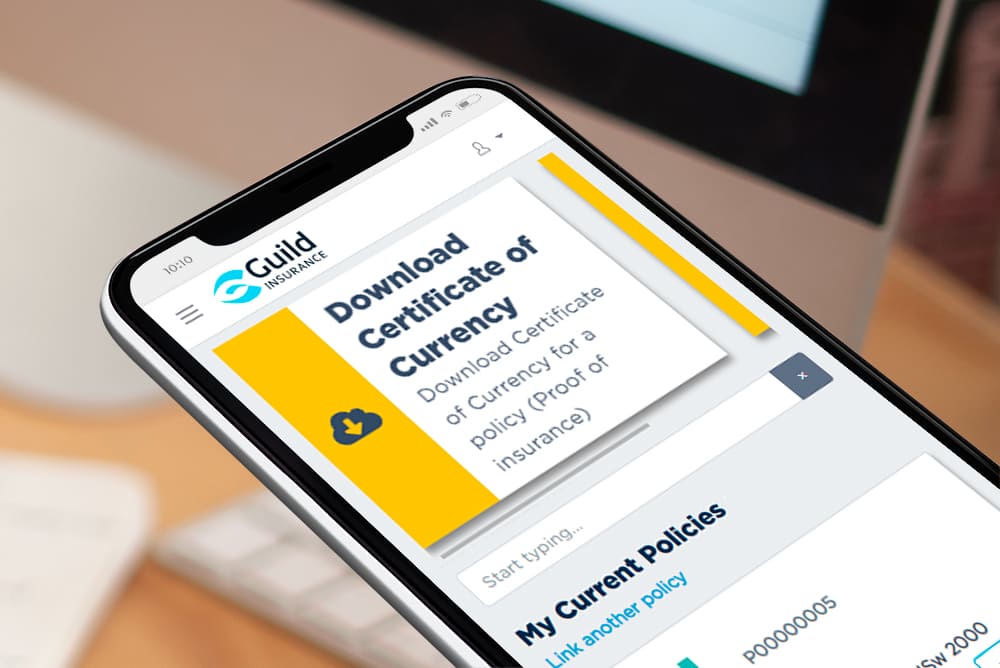

Login to PolicyHub for all your policy needs

- All-In-One Dashboard: Manage all your policies and documents in one place.

- Easy Updates: Quickly update personal and business details online.

- Enhanced Security: Protect your account with multi-factor authentication.

- Document Access: Instantly access policy documents and tax invoices.

- Claim Management: View current and past claims effortlessly.

- Flexible Payments: Update billing details.

- Policy Renewal & Reinstatement: Renew or reinstate policies with ease directly through PolicyHub.

- Certificates of Currency: Obtain proof of insurance with just a few clicks.

FAQs

The law governs that any professional exercise the required skill to an appropriate level expected by that profession. A professional may be liable for financial loss, injury or damage arising from an act, error or omission of fault if the professional has not acted to the required level of skill deemed in that profession. Failure through this may result in the claimant (person who suffered the loss) be awarded for that loss, damage or injury.

Many professions require you to hold a professional indemnity insurance policy by law, such as Ahpra registered professions, but can be for other industries such as financial institutions also. Please check with your registration body or associations of your profession to know if it is required by law to have professional indemnity insurance. It is often also required by companies who take on contract workers that are not governed under the companies own insurance policy. It is acceptable for a company to ask you as the professional contractor to provide evidence of cover for professional indemnity before starting the contract period.

As stated above professional indemnity insurance covers you for breaches in relation to your professional duty. Liability insurance covers you for activity that results in personal injury or property damage as a result of your business activities that do not relate to your specific profession. An example may be someone who trips and is injured from spilled water within your office may be covered under liability, because it is your duty of care as business person to provide a safe environment. Whereas a person who suffers a loss or injury because of your professional treatment in relation to your job has caused it would usually be consider as an indemnity breach.

Generally business insurance is to cover the physical assets of your business for material damage loss and options for theft cover. It can also include cover for financial loss due to business interruption. Usually basic insurance does not cover breach of duty or flood cover, but if you speak to an insurance specialist it can often be added to your policy for a nominal fee.

Depending on the policy you are taking out, covers will often vary. At Guild insurance we specialise in making a policy to suit your business so that you are not over paying for covers you wouldn't normally need. The best thing to do is call 1800 810 213 to speak to an insurance specialist, they can find out what activities and structure your business is in to then provide you with adequate cover for you.

A certificate of currency (or COC for short) is a written document that confirms that your insurance policy is current and valid at a specific date and time. At Guild we provide easy access to your COC at any time within a few clicks of our online portal PolicyHub. If you are a new customer we can provide you with one post purchase.

Write a review Average rating: